Which businesses will profit from PDP8?

According to VNDirect, the PDP8 might benefit M&E and RE EPC contractors first, followed by wind power and gas-fired power plant developers.

GAS could be also a key beneficiary in the LNG-to-power transition in PDP8 with the LNG terminal projects.

>> PDP8 marks a boost for Vietnam power sector

Following the significant commitments made at COP26 and COP27 to achieve the "netzero" objective by 2050, the Vietnamese government has turned its focus from the PDP7 revision to a more intensive green transition in the PDP8.

Actualizing green ambition

Large financial pressure is exerted to satisfy demand for power generation under the strong energy transition scenario. When compared to the PDP7 scenario, this scenario will significantly reduce fossil fuel imports, improve electrical supply security, and reduce the burden of power imports. However, based on the load scenario, the energy conversion scenario will increase the investment cost for power systems by 25-32% in the 2021-50 timeframe.

According to VNDirect, the PDP8 has produced a "sufficient and green" plan, but it may be more difficult to implement than the amended PDP7 due to the strong emergence of gas-fired and RE power, while hydrogen and ammonia technologies for thermal plants are still being researched and are not yet commercialized.

In example, total investment demand for electricity capacity is expected to reach US$114 billion between 2021 and 2030, with capital requirements accounting for 30% and 35% of total capital, respectively. Coal-fired power plants also have a high capital need of 15% of total capital. Total capital for capacity expansion will reach $495 billion in the 2031-50 timeframe, with wind power needing the most (63% of total capital), followed by the return of solar power (18%).

Capital requirements for power grid development, on the other hand, account for approximately 11%-7% of total power sector investment in the 2021-30F and 2031-50F time periods, respectively.

>> Gas-fired power to rebound from its low base

Here are the beneficiaries

According to VNDirect, the PDP8 will pave the way for the Vietnam power industry while also providing a significant potential for power company growth in the next years. It mentioned some of the promising sectors that benefited from the PDP8:

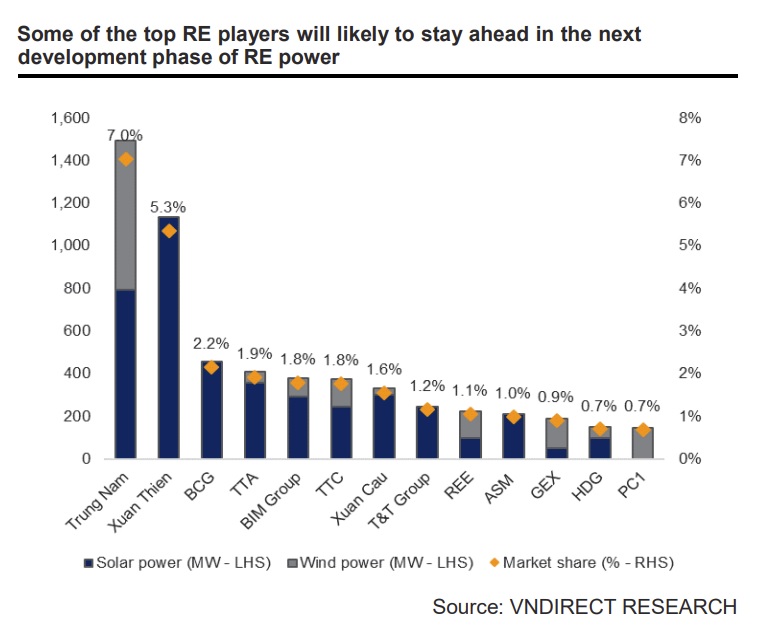

First, it expects power plant contractors to profit the most quickly as a result of the high workload under the PDP8 fast capacity expansion, particularly in gas-fired and RE generation. Power M&E operations will also increase rapidly in the coming year, in tandem with the rapid development of power sources. The biggest influence on the RE development prospects, however, will be the new price structure for these energy sources, which has yet to be determined.

"We see some of the best M&E and EPC contractors, such as PC1, FCN, and TV2, as the first to benefit from this trend." Longer term, PVS will gain from offshore wind power development due to its offshore construction capabilities as well as its recent participation in several offshore wind power projects (Thang Long, La Gan, and so on)," according to VNDirect.

Second, numerous promising listed names own new development projects in gas-fired power in general and LNG-to-power in particular, including Nhon Trach 3 and 4 (POW), LNG Long Son (PGV, TV2), and O Mon III and IV (Genco 2). With the LNG terminal developments, VNDirect expects GAS will benefit significantly from the LNG-to-power transformation in PDP8.

Third, VNDirect anticipates that PDP8 certification would provide the impetus to restart long-stalled, multibillion-dollar gas field projects such as Block B and Blue Whale in the coming years, securing domestic gas sources and lowering imported LNG for power generation in Vietnam.