Will the USD dollar have more strength in the short term?

Momentum remains with the US dollar, and, while we do not see this as the long-term outlook, it is hard to argue against more strength in the short term.

The euro/dollar is still unlikely to stray too far from the 1.05–1.10 range

>> What are the prospects for major currencies?

The US dollar remains in ascendancy, and perhaps the only surprise in light of recent developments such as relatively robust US growth, surging long-term Treasury yields, and the rise in oil prices is that the dollar is not stronger yet. The fact that it is not might be down to the fact that current prices adequately reflect much of this positive news for the greenback. An alternative explanation is that the US dollar still has to catch up, which implies much more short-term strength ahead.

Mr. Steve Barrow, Head of Standard Bank G10 Strategy, leans to the former argument, which implies that further strength from here will be modest, but there’s no doubt that the situation lies on a knife edge. “The reason we see this is that surging Treasury yields can produce dollar strength in two main ways. The first happens if yields rise more than elsewhere, which has generally been the case this time around. But this interest rate differential support for the US dollar can be compounded dramatically if the surge in US yields starts to produce financial distress, and, so far at least, the evidence of this is not compelling. For example, a commonly used measure of financial strain, the US VIX index of stock market volatility, has only risen to the 20 region despite the dramatic surge in US long-term yields. Factors such as this lead us to believe that the euro/dollar, for instance, is still unlikely to stray too far from the 1.05–1.10 range that has been in place for the vast bulk of this year”, said Mr. Steve Barrow.

This being said, a temporary slide to parity is clearly possible given the growth discrepancy between the US and the euro zone and the surge in Treasury yields. But a deeper and longer-lasting slump in the euro/dollar would require real concern about dislocation in the euro area. This could potentially come from a number of sources. One is a marked hit to the economy from a surge in energy prices and/or energy supply problems over the winter period. ECB President Lagarde argued recently that the energy supply situation appears comfortable, and Mr. Steve Barrow agrees with this. However, the risk around energy prices represents a much more serious threat, particularly in light of the conflict that has been reignited in Israel and the subsequent surge in oil prices.

>> How will the US dollar react to a soft landing in the US?

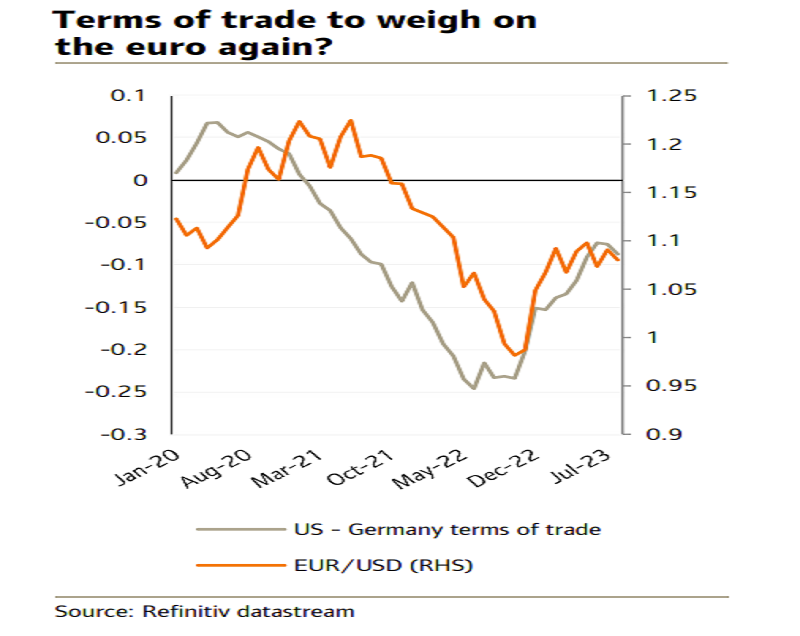

We have seen many times in the past that the movement in energy prices can have profound effects on the euro/dollar rate given the euro zone’s dependence on imported oil and gas compared to the US’s relative self-sufficiency. This was clearly demonstrated in the early stages of the war in Ukraine, as the price of gas imports into the euro zone increased dramatically and hit the euro hard as the region’s terms of trade deteriorated. But through much of the past year, the euro zone’s terms of trade have recovered relative to the US. This has helped the euro/dollar rally from sub-parity levels to over 1.10, but now the trend in terms of trade has started to turn back against the euro, and this could deteriorate much further if oil prices continue to explode higher. However, even here, we remain more optimistic than pessimistic, as soft global growth will weigh on energy demand and so contain the rise in oil prices.

A second source of risk to the euro comes from the fact that rising bond yields could cause systemic problems within the euro zone that are not dissimilar to the strains that very nearly forced Greece out of EMU just over a decade ago. Bond market spreads between “safe” bond markets, such as Germany’s, and more “risky” ones, such as Italy, have ballooned just recently as Treasury yields have surged. It is another potential case of the US sneezing and the rest of the world catching the cold. And while this might prove most applicable to riskier emerging market debt, it could conceivably trip up euro zone bond markets and the euro into the bargain.

“We have long argued that this is a significant threat caused by the rise in debt in the wake of the pandemic, and now, in light of the surge in Treasury yields, However, we believe such pressures will remain within the bond market and will not spillover materially to the euro. Hence, while parity is a risk for the euro/dollar, we do not expect a sustained and significant slide in the euro from here, and, in 2024, as the US monetary policy debate turns full circle, the dollar should start to fall”, said Mr. Steve Barrow.