Banking stocks lead the market: Which ones stand out?

After surging 41% in 2025, the VN-Index extended its rally into early January, reaching a record high of 1,902.9 points on January 13 (6.6% compared to end-2025).

In January 2026, most sectors advanced, led by Oil & Gas. The sector posted the strongest gain (43%), driven primarily by PLX (67%) and OIL (51%). Utilities followed (32%), supported mainly by GAS (62%). Basic Materials (19%) ranked third, with notable performers including GVR (52%), KSV (134%), and MSR (65%). In contrast, Real Estate (-13%), Industrials (-5%), and Consumer Services (-1%) underperformed.

Although banking was not the top-performing sector in January, select large-cap lenders benefited from Politburo Resolution No. 79-NQ/TW dated January 6, 2026 on state economic development. Many bank stocks reinforced their “king stock” status and, more importantly, continued to be the largest contributors to overall profit growth.

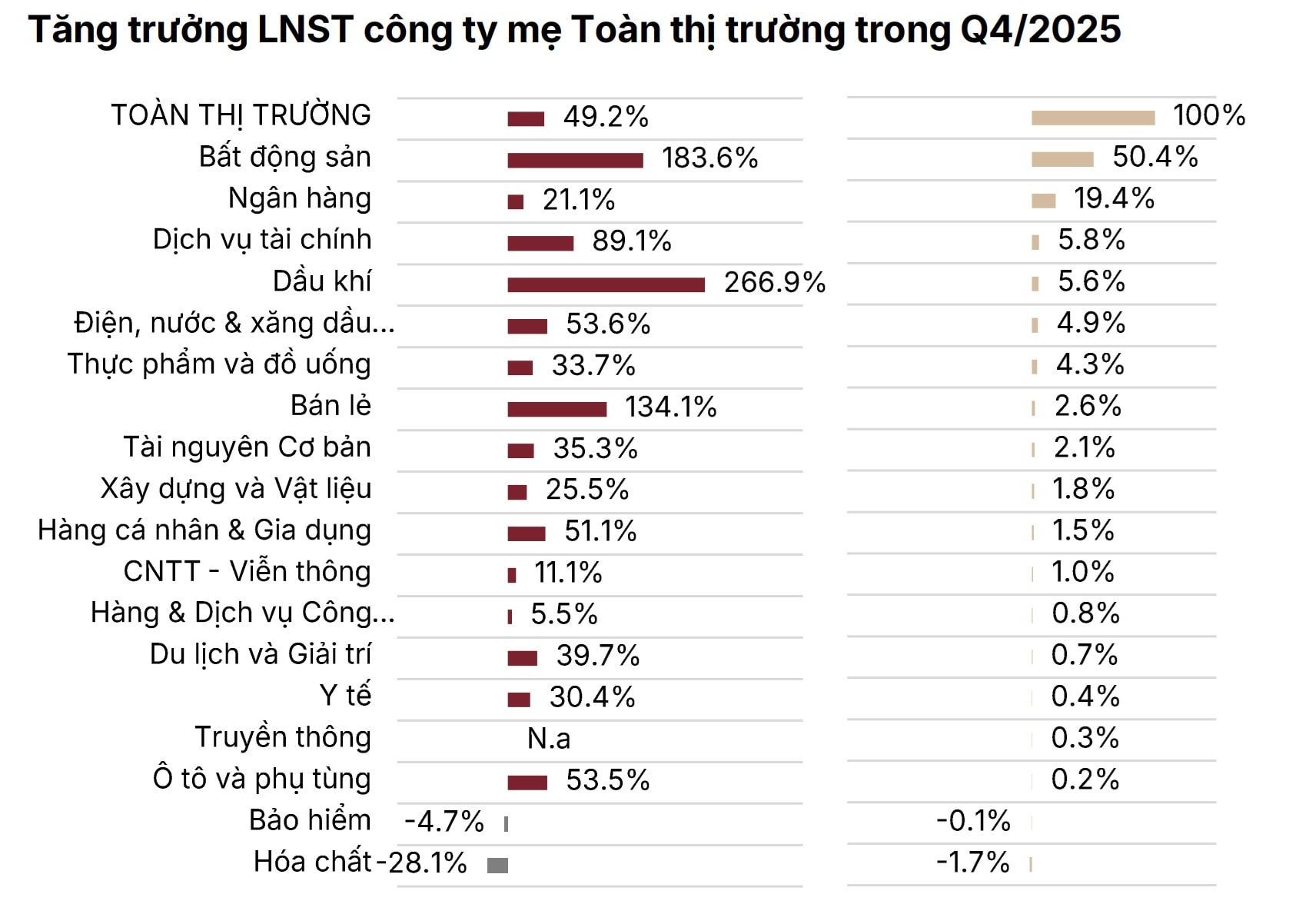

According to SSI Securities, fourth-quarter 2025 revenue across the market rose 26.5% year-on-year (YoY), significantly higher than the 10.6% YoY growth recorded in the first nine months of 2025. Net profit after tax attributable to the parent company (NPATMI) increased 49% YoY across all three exchanges and 44.7% YoY on HOSE, marking a clear acceleration from the 27.7% and 21.8% YoY growth, respectively, seen in the first nine months.

Banking and real estate sectors remained the two largest drivers of profit expansion, with net profit up 21.1% and 183.6% YoY in Q4 2025. Together, they accounted for around 70% of the absolute profit increase across the market during the quarter, SSI’s February market report noted.

Other sectors also recorded notable improvements, including Oil & Gas (267% YoY, largely due to BSR), Financial Services (89%), Retail (134%), and Materials (35%). Meanwhile, Chemicals and Insurance posted weaker results, weighed down by storm-related compensation costs and company-specific factors.

Despite broad-based earnings growth, HOSE performance remained highly concentrated. Ten stocks — including NVL, Vingroup-related names (VIC, VHM, VRE), energy stocks (BSR, PGV), and major banks (BID, VPB, TCB, MBB) — contributed 83% of net profit growth in Q4. Excluding these, Q4 profit growth on HOSE would have been only around 10% YoY.

For full-year 2025, market-wide NPATMI rose 33.8% YoY, while HOSE NPATMI increased 28.1%, supported by 15.4% revenue growth among listed firms. Within SSI’s 83-stock coverage universe, NPATMI rose 38.7% in Q4 and 20.3% for the full year. Earnings outperformance was concentrated among Vingroup-related companies, state-owned commercial banks (SoCBs), and utilities such as PGV.

Banking Sector Outlook

SSI estimates that Q4 2025 NPATMI for the banking sector grew 21% YoY, exceeding analysts’ forecasts, though profitability remained uneven. ACB recorded a significant decline, while STB reported a quarterly loss. Conversely, most banks posted double-digit growth, led by TCB (95% YoY), VPB (66%), HDB (60%), BID (52%), and MBB (38%).

Credit growth among covered banks accelerated to 20% year-to-date — the highest since 2017 — driven by MBB (36.5%), VPB (35%), and HDB (31%).

Liquidity remained under pressure in Q4 due to structural mismatches between medium- and long-term lending and short-term funding, alongside rapid credit expansion and slower deposit growth amid prolonged low interest rates. After deposit rates rose 120–180 basis points during the quarter, deposit growth rebounded 5.5% QoQ (16.7% YTD). Net loan-to-deposit ratios (LDR) eased to around 100% by year-end, though they were still elevated.

Growth in parent company net profit after tax across the market in Q4 2025

Asset quality improved across most banks following VND 40.6 trillion in bad debt resolution in Q4 2025. The sector’s non-performing loan (NPL) ratio declined modestly, though loan loss reserve (LLR) coverage fell to 89.3% in 2025 from 105% in 2024.

Net interest margins (NIM) expanded by 10 basis points QoQ, supported by improved asset yields and higher-yield asset mix, while the full impact of rising funding costs has yet to be fully reflected.

Non-interest income also strengthened, driven by a recovery in fee income (32.6% YoY) and recoveries from written-off loans (53% YoY).

Market Outlook and Stock Picks

With the VN-Index fluctuating below 1,800 points and liquidity softening ahead of Lunar New Year, SSI expects trading activity to slow in the final pre-holiday week before rebounding afterward. Historically, the probability of market gains around Tet is high: 87.5% in the week before Tet and 75% in the two weeks after.

For 2026, SSI maintains a base-case VN-Index target of 1,920 points. The market is currently trading at a forward 2026 P/E of around 13x, below the 10-year historical average.

Among February’s investment ideas, SSI highlights MBB with a target price of VND 33,400 per share, implying 21.4% upside. MBB continues to lead in credit and deposit growth, maintains stable NIM, and benefits from a diversified financial ecosystem.

VDSC’s 2026 banking picks include:

- VCB (Vietcombank): Strong fundamentals, high credit quota advantage, low NPL (0.58%), expected private placement catalyst.

- BID (BIDV): Scale-driven credit expansion, improved NIM (2.45%), strong non-interest income recovery.

- CTG (VietinBank): Fee income growth, CASA improvement, and retail/SME focus to enhance margins.

- MBB (MBBank): System-leading credit growth, diversified ecosystem, declining provisioning pressure.

- VPB (VPBank): Capital strength supports >30% credit growth target; subsidiaries (VPX, OPES, FE Credit) add earnings momentum.

- ACB: Potential credit quota expansion, strong provisioning buffer, focus on FDI and corporate lending.

Banks are expected to remain the core earnings driver in 2026, with select names offering attractive upside amid supportive macro conditions.