Easing pressure on the exchange rate

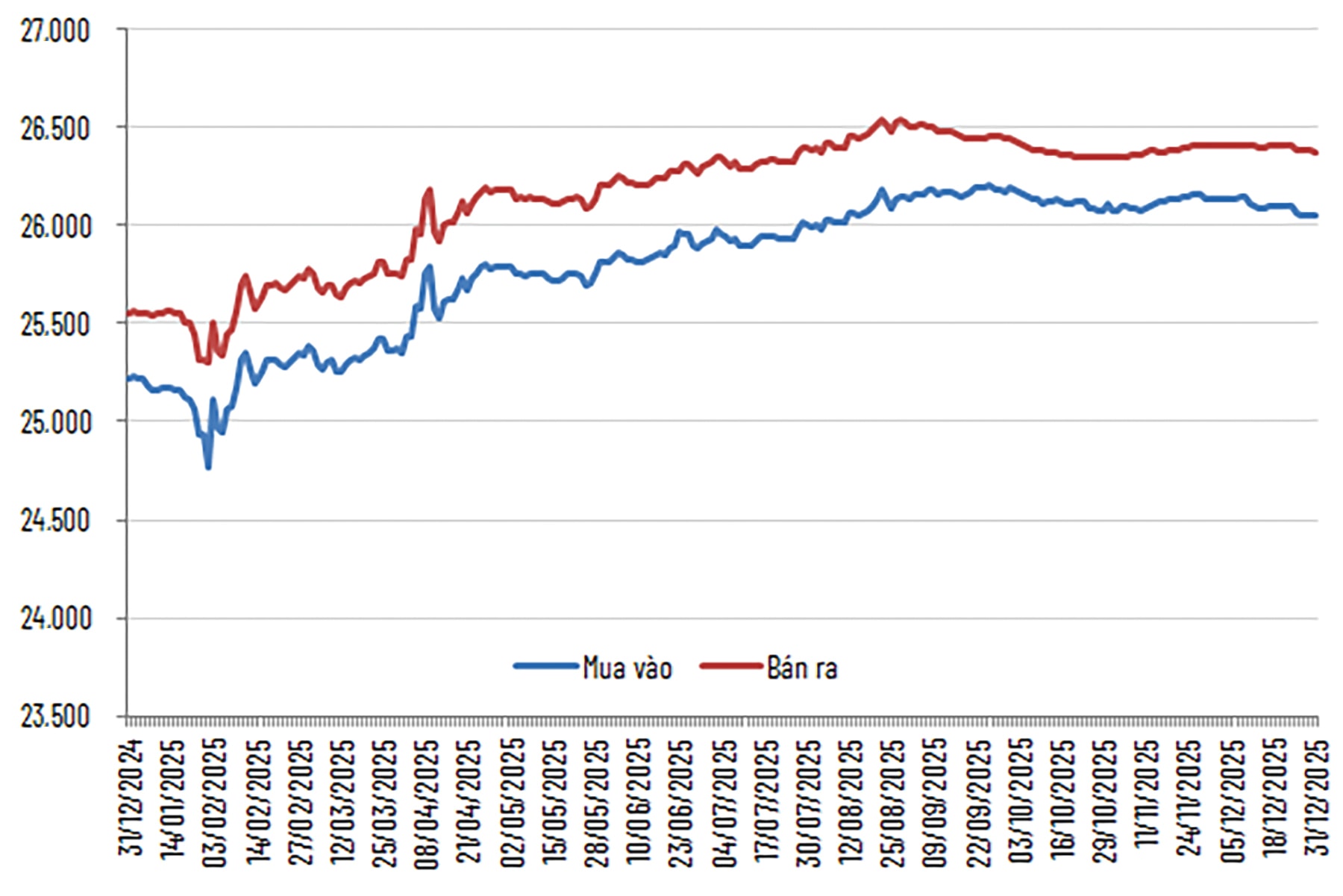

In 2025, the USD/VND exchange rate rose by around 3.2%, remaining within the band set by the State Bank of Vietnam (SBV). However, when viewed in a broader context, challenges facing the exchange rate persist.

Entering 2026, analysts expect these pressures to ease thanks to more favorable macroeconomic conditions, although several variables will still need close monitoring.

Expectations from global macroeconomic uncertainties

The focal point of global financial markets continues to be the policy direction of the US Federal Reserve (Fed). While forecasts differ regarding the pace and scale, the Fed’s trajectory toward interest-rate cuts to rein in inflation appears increasingly irreversible.

Ms. Vu Ngoc Linh, Director of Analysis at VinaCapital, noted that for the US economy, the Fed is likely to continue cutting rates this year. Current forecasts lean toward two rate cuts of 50 basis points each, bringing the policy rate to around 3%. This development is expected to provide meaningful support for the stability of the Vietnamese dong.

Sharing this view, Mr. Suan Teck Kin, Head of Market and Global Economics Research at UOB Singapore, said a more accommodative Fed stance would serve as a buffer for the exchange rate, even though the VND was the third-worst performing currency in Asia in 2025. He also expects exchange-rate management to remain a top priority for the SBV, incentivizing policymakers to keep the refinancing rate at 4.5%.

Meanwhile, China’s economic situation is another important external factor. The country’s recovery remains slow and uneven, which indirectly helps limit imported cost-push inflation risks transmitted to Vietnam through trade and supply chains.

“These two factors—from the US and China—suggest a high likelihood that the exchange rate in 2026 will be more stable than last year, while inflationary pressures should remain manageable. The domestic economy is expected to move from a phase of absorption and recovery into one of acceleration, as growth drivers gain traction,” Ms. Vu Ngoc Linh said.

Liquidity considerations and policy scenarios

From a technical perspective, the USD/VND exchange rate has generally moved sideways recently, partly thanks to the wide USD–VND interest rate differential reflected in swap rates. However, the rate has not fallen decisively due to the lack of sufficiently strong, proactive USD inflows into the system. Although remittances typically surge ahead of the Lunar New Year, this source of foreign currency must be viewed against the expanding scale of the overall system. According to many experts, swap rates hovering around 3–4% accurately reflect current conditions, as the system is approaching its limits and the SBV’s new swap instruments only partially alleviate pressure.

Regarding specific exchange-rate scenarios, expert Brian Lee Shun Rong projects that the SBV will maintain its policy rates throughout 2026. This forecast is based on inflation remaining within target and authorities prioritizing GDP growth. Nevertheless, the risk of tighter monetary policy persists should growth exceed expectations or exchange-rate pressures resurface. The MIBG foreign exchange team forecasts that the VND may weaken slightly against the USD, pushing the rate to around 26,650 USD/VND (equivalent to a 0.4% depreciation compared with 2025).

Mr. Suan Teck Kin of UOB Singapore forecasts the USD/VND rate to move from around 26,300 in the first quarter of 2026 to 26,100 in the second quarter, 26,000 in the third quarter, and 25,900 in the fourth quarter of 2026. This outlook reflects expectations that the USD will continue to weaken in 2026 as the Fed increasingly scales back its central bank independence.

In addition, analysts expect that, alongside an upgrade of Vietnam’s stock market classification, the return of foreign investors will mark a reversal from 2025, generating net capital inflows and easing exchange-rate pressure.

Against this backdrop, businesses are advised not to “bet” on exchange-rate movements, particularly import-export companies. The use of derivatives such as forward contracts or options to lock in costs is recommended, along with a 50/50 hedging rule—hedging at least 50% of projected foreign currency needs over the next six months.

At the same time, firms are encouraged to diversify settlement currencies rather than relying solely on the USD, negotiating payments in EUR, JPY, or even CNY when dealing with partners in relevant regions to mitigate single-currency risk. In the 2026 environment, many experts believe borrowing in VND remains the safer option, unless a company has clearly matched and reliable foreign-currency revenues.