Gold prices: Buy the dips

Gold prices may continue to correct and consolidate next week, allowing investors to evaluate investing possibilities if the gold price falls below $1,900/oz.

The price of SJC gold bars posted by DOJI has climbed from 68.1 million dong/tael to 68.35 million dong/tael.

>> Will the gold price's headwinds reverse?

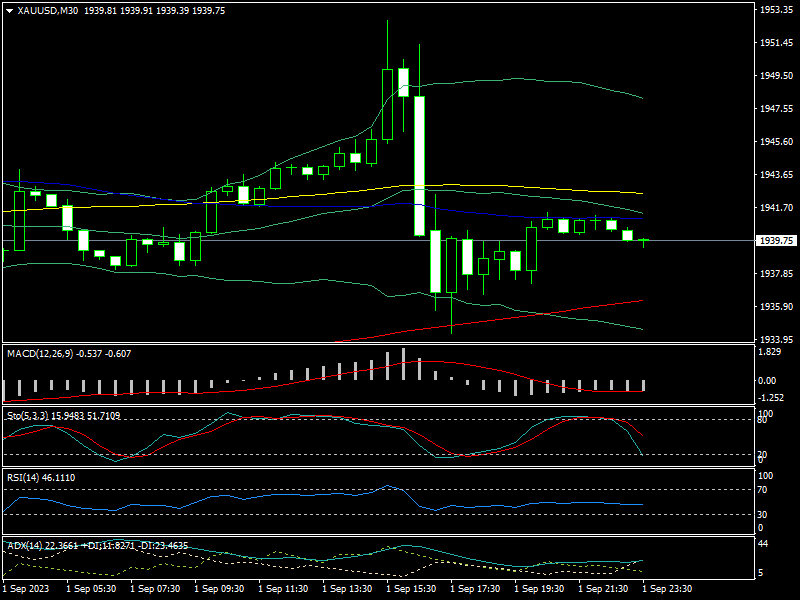

This week, the worldwide spot gold price steadily increased from $1,912/oz to $1,952/oz, eventually closing at $1,939/oz.

The price of SJC gold bars posted by DOJI on the Vietnamese gold market has climbed marginally, from 68.1 million dong/tael to 68.35 million dong/tael.

The Bureau of Labor Statistics said Friday that nonfarm payrolls in the United States increased by 187,000 in August. The monthly total was higher than the market consensus of roughly 169,000.

At the same time, the US unemployment rate increased to 3.8%, above market expectations for an unchanged reading of 3.6% in March. According to some experts, the increase in the jobless rate is also attributed to an increase in the participation rate, which drove it to 62.8%, up from 62.6% in July.

While the headline figure was somewhat higher than expected, experts note that, in addition to the rise in the unemployment rate, there are other signals that slack is gradually building in the labor market. The employment numbers for June and July were sharply revised lower in the report. July's employment figures were revised down to 157,000 from an early estimate of 187,000. Meanwhile, June's figures were cut down to 105,000 from 185,000 before.

Cooling wage inflation is another element supporting gold prices. According to the data, average hourly salaries grew by 0.2%, or eight cents, last month to $33.82. Economists expected 0.3% wage increase, according to consensus estimates.

Markets are gradually pricing in a rate rise before the end of the year. Markets have virtually totally priced in no change later this month, according to the CME FedWatch Tool. At the same time, they believe the Federal Reserve will keep interest rates steady in November. Prior to the employment statistics, investors expected one more rate rise this year.

According to Andrew Hunter, Capital Economics' deputy chief US economist, the August employment data shows that labor market conditions are reaching pre-pandemic levels, implying that the Fed is unlikely to increase interest rates further.

>> Will gold’s bearish reversal continue?

"This reinforces our view that the Fed's next move will be an interest rate cut in the first half of next year," he wrote in a note. "We continue to expect weaker labor market conditions to contribute to a rapid decline in core inflation, persuading the Fed to cut rates more aggressively than markets are pricing in next year."

Gold prices may swing in the next week

With limit ed economic data due out next week, economists advise investors to keep a watch on the US dollar and bond rates to discover gold price movements and decide on gold investment plans.

The US dollar index is currently at a nearly three-month high of more than 104 points, while 10-year US bond rates, albeit down from last week's 15-year peak, remain above 4%. If these two factors persist at their current levels, the advance in gold prices next week will be hampered.

Because the Stochastic is displaying overbought signs, the gold price may continue to decline somewhat next week to 1,930 USD/oz (MA50). If this level is not held, the gold price may continue to move to 1,914 USD/oz (MA200) next week. Meanwhile, gold prices will face significant resistance next week at the level of 1,954 USD/oz (MA100). If this level is breached, the gold price will rise even more the next week.