Will gold’s bearish reversal continue?

Analysts believe that concerns about credit conditions and the debt limit dispute will maintain gold prices at historically high levels for the foreseeable future.

The price of SJC gold bar in the Vietnamese gold market declined to 67.1 million dong/tael after rising to 67.45 million dong/tael.

>> Central banks buy gold, gold prices will break out

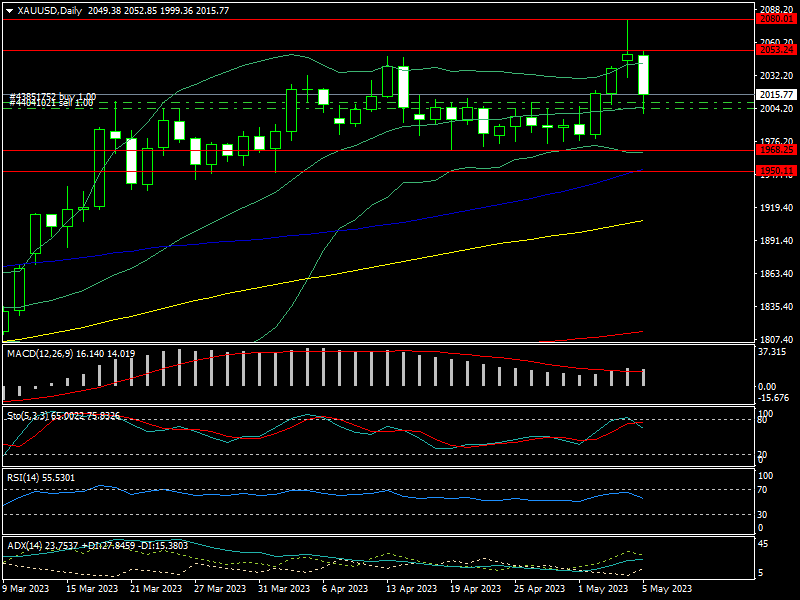

The gold price rose sharply this week, from 1,976 USD/oz to 2,080 USD/oz, after the Fed boosted interest rates by 0.25% and indicated a shift to a neutral monetary policy.

However, in the midst of the euphoria, investors were swayed when Fed Chairman Powell stated that the Fed would be unable to decrease interest rates anytime soon.

"We on the committee have a view that inflation is going to come down not so quickly. It will take some time, and in that world, if that forecast is broadly right, it would not be appropriate to cut rates and we won't cut rates", said Powell.

The FED Chairman's comments prompted investors to take profits, leading the gold price to fall from $2,080/oz to $2,030/oz. Gold fell further to $1,999/oz after the US Bureau of Labor Statistics employment data indicated that the US economy added 253,000 jobs in April, above predictions of 180,000 jobs. Simultaneously, the jobless rate declined to 3.4%, while wage inflation surged by 5%.

According to the DOJI listing, the price of SJC gold bar in the Vietnamese gold market declined to 67.1 million dong/tael after rising from 67.15 million dong/tael to 67.45 million dong/tael. The domestic gold price changed little in comparison to the global gold price, and the transaction was quite calm.

>> FED likely to stop hiking rates, gold price will break out?

Despite Powell's constant message, gold markets have begun to price in the FED's likely rate drop as early as July 2023. That is, until they were confronted with a harsh truth.

Gold has not reached its top, according to investors, since prices will be pushed by safe-haven demand.

Analysts have been unequivocal: the central bank cannot pivot and lower rates in this scenario. Gold prices have taken a beating as market forecasts for interest rates continue to fluctuate. Gold has not reached its top, according to investors, since prices will be pushed by safe-haven demand.

One big issue causing concern in the market is the ongoing financial crisis caused by the failure of First Republic Bank. This catastrophe is only beginning. According to Mr. Colin, an FX expert, future bank failures might wipe away $10 trillion in equity.

"Concerns over the financial crisis and the US debt ceiling will maintain gold prices at historic highs for the foreseeable future. However, after these concerns have passed, we will face headwinds”, said Colin, adding that gold prices will continue to rise, with a crucial support level around $1,950-$1,990/oz and a strong resistance level at $2,050-$2,080 USD/oz.

Technically, gold has moved through a series of lower highs and has found firm support at $1980. As a result, an asymmetrical triangular design with a falling top and a flat bottom was formed. This sort of asymmetrical triangle is typically formed during a price correction, and after pricing hits the peak of the triangle, market experts seek for a break to lower pricing. This pattern can occasionally be encountered during an increase, as shown this week in gold. As a result, as long as the gold price continues over $1,950/oz, or even $1,900/oz, the upward trend will continue.