The FED’s policy and impacts on Vietnam

The FED could be less aggressive but will not stop interest rate hikes soon, according to KB Securities.

The FED is unlikely to lower interest rates next year

The picture of the US economy appears dark, considering recently released economic data. In more detail, the economy posted negative GDP growth for two consecutive quarters. The composite purchasing managers' index (PMI) plummeted for five straight months to 44.6, consistent with the manufacturing PMI (down 5.8 percentage points to 52.8 percent in August) following a decrease in industrial production and output for two months in a row amid dropping new orders and weak demand.

Food, foodstuff, and gasoline prices spiraled, adding to already high inflation (hitting 8.5% in July) and hampering consumer purchasing power and consumption of non-essential goods. The number of backlogs and jobs at factories did not increase significantly. Retail sales also showed signs of leveling off, rising by 0.7-0.9% MoM in the last two quarters and even declining if adjusted for core inflation.

The only bright spot in the US economic picture, which is why the National Bureau of Economic Research (NBER) has not declared a recession, is that the labor market continues to shine. An average of more than 11 million jobs were opened each month, helping to keep unemployment at the lowest level in the post-pandemic period. Initial and continuing jobless claims also contracted by - 39.36% YoY and -40.12% YoY, respectively.

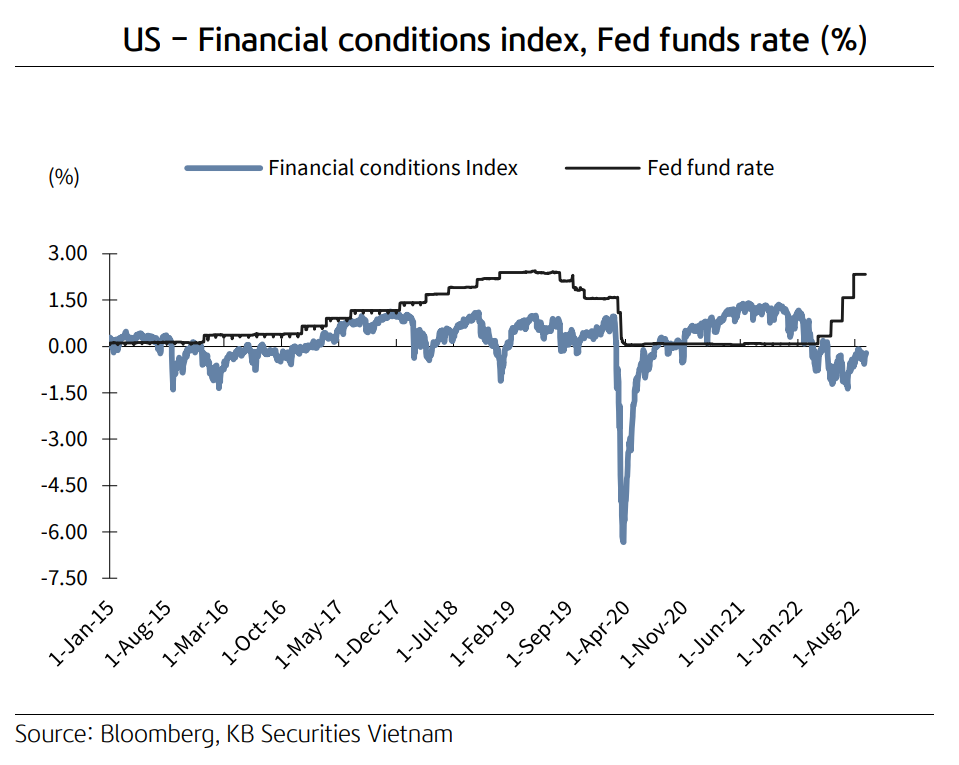

The better-than-expected employment data is the key behind the Fed’s move to deliver big rate hikes in its two remaining policy meetings in 2022. Up to now, the Fed has raised the benchmark overnight interest rate four times to a range of 3.00-3.25% and will likely announce another 75bps increase at the next meeting. The US Fed funds rate is expected to hit 4.0-4.25% by end-2022.

Given inflation is approaching its peak and the US economic health is showing signs of slowing, Mr. Tran Duc Anh, Head of Macro & Strategy at KB Securities, expects the FED to be less aggressive in raising interest rates in 2023 with an increase of no more than 0.5%. However, the FED is unlikely to lower interest rates next year and will instead keep them high due to:

First, a FED flip-flop on interest rates too early could loosen financial conditions across the money, bond, and stock markets. It goes against the intention of the central bank to force investors and consumers to become more cautious in spending and borrowing, thereby suppressing demand and helping inflation gradually approach the long-term target of 2%.

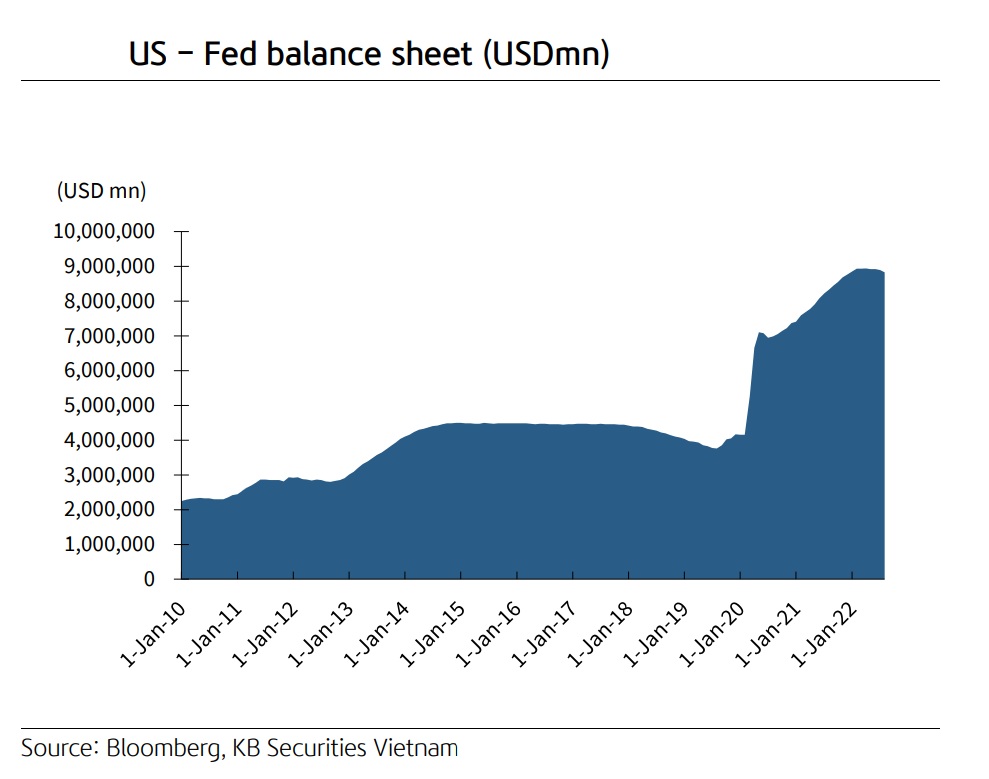

Second, in the COVID-19 period, the Fed bought more than VND5,000 billion of various types of bonds, primarily Treasuries and mortgage-backed securities, from banks and credit institutions in support of the economy through quantitative easing (QE). So far, the central bank has only sold approximately USD2 for every USD100 of bonds purchased during the pandemic. It still has a lot to do to normalize monetary policy before considering a policy reversal.

>> How will FED’s monetary tightening affect the USD?

Third, although many US manufacturing and technology enterprises cut staff and the number of people quitting jobs exceeded the pre-pandemic high (2.8% in 2Q22 vs. 2.3% in the pre-Covid period), the US labor market remains tight. Job openings were far above unemployed workers, so they did not hesitate to switch jobs for opportunities that better fit their needs. Statistically, private-sector wages and salaries in the US grew by 5.7% over the same period, the highest increase since 2001.

Inflation is likely to remain high, causing workers to command higher wages to keep up with the rising cost of living. Economists are worried this will lead to a wage price spiral. Rising income will encourage consumers to shop and invest more, as proven by consumer credit growth hitting its record high of 7.3% YoY since 2011 and the personal savings rate falling to its lowest level since 2009. Moreover, businesses have to offer a pay rise due to scarce labor, causing the selling prices of final products to spike and making it impossible for inflation to cool down.

Fourth, in addition, a factor driving inflation in August was home prices and rents that maintained an upward trend, although the growth somewhat slowed. From the supply side, housing prices in the primary and secondary markets in the first eight months of 2022 are 10 to 15% higher than in 2021. The rent increase has not contributed much to overall inflation of 7-8% for the time being, since lease renewals usually last from six months to one year. Also, a sharp increase in Fed funds rates that pushed home loan interest rates up also added to a huge rent hike (up 4.5% compared to the beginning of the year).

In addition, from the demand side, workers choose to change their workplace for lucrative salaries. It also supports the upward momentum in rents in the foreseeable future and makes this trend less likely to reverse. It will make the Fed more committed to its hawkish stance and will not ease monetary policy anytime soon if the labor market remains too tight. In the base case scenario, KB Securities believes the US labor market will see the unemployment rate touch 4.2% to achieve the inflation target of 2%.

Fifth, the early reversal of tight monetary policy could end up weakening the USD and fueling persistent rises in inflation due to spiking import prices amid the supply chain disrupted by the ongoing conflict between Russia and Ukraine.

Sixth, hard as it is, the Fed is hoping to achieve a proverbial'soft landing’ for the US economy, in which inflation falls steadily and approaches the target level while GDP decreases marginally and the unemployment rate increases moderately. In this scenario, the Fed can maintain high interest rates until the inflation target is reached. A recent Bloomberg survey shows that the probability of a recession is 50% for the time being, up from 40% after two months since the Fed raised interest rates in July.

Mr. Tran Duc Anh said in the base case scenario for 4Q22, US inflation progressively cools down (reaching 8% YoY in December 2022 and 3.6% YoY by the end of 2023). The US economy, therefore, can maintain its growth momentum at 0.2% with a somewhat weaker labor market (unemployment up from 3.7% to 4.2%) and avoid the worst case of a hard landing. Accordingly, the impact on Vietnam's stock market is not too severe since it is consistent with the market's expectations. Furthermore, the general downtrend of the market since early September has reflected risk factors. At that point, internal factors like the domestic economy and business activities of listed companies will play a pivotal role in shaping the general market trend.

In the most pessimistic scenario, the growing risk is that the US economy will fall into stagflation in the first half of 2023, in which inflation remains high (CPI remains above 8% YoY), squeezing the economy. The US stock market may then tumble by approximately 20% from the current range following a decrease in reasonable P/E valuation (due to the rapidly increasing interest rates) and shrinking earnings growth of listed companies (due to the economic downturn).

At that point, the Vietnamese stock market will also inevitably be affected, with a correction of 10-15% (below that of the US stock market, backed by domestic economic growth and the high earnings growth of listed companies). However, Mr. Tran Duc Anh assesses this scenario is less likely to happen and will closely follow US inflation and employment rate.