VN30 1H23 review: BCM could replace KDH

HOSE will announce the VN30 index result on January 16, 2023, which will be effective on February 6, 2023.

Many investors are following the VN30 1H23 review

>> ETF Monitor: Time to review international ETFs

Leverage from net ETF inflows

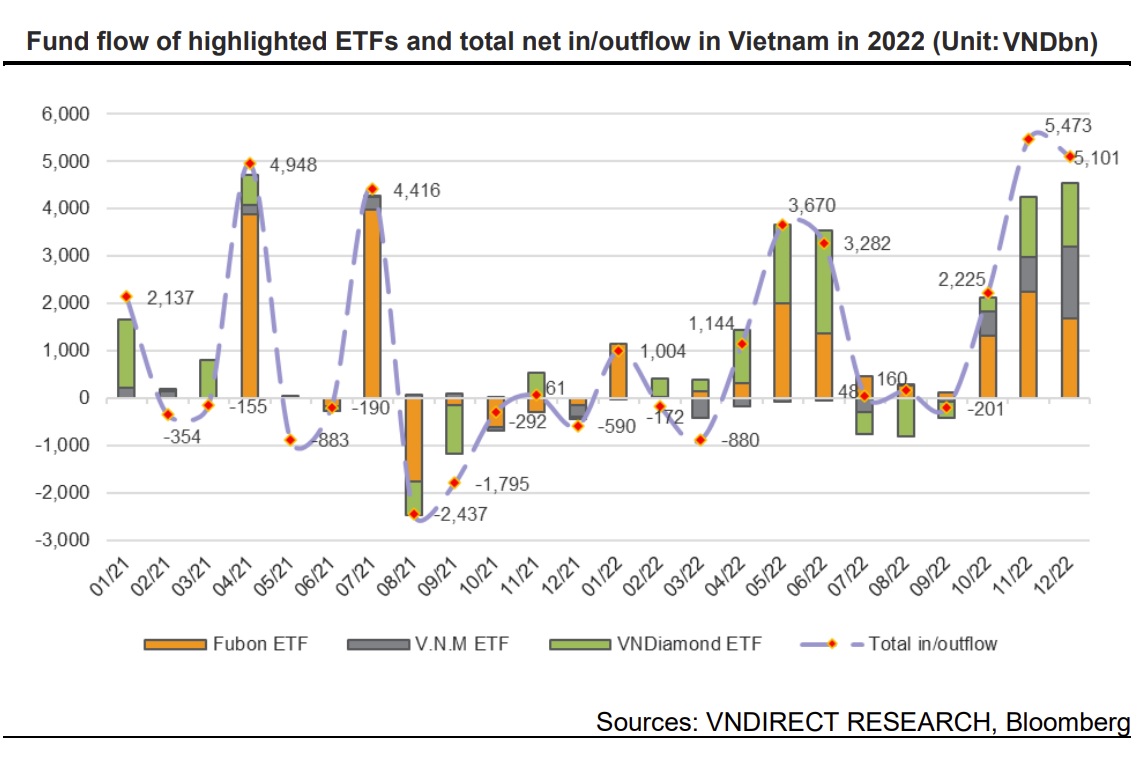

ETFs recorded a net inflow of VND12,636 billion (US$537 million) into Vietnam in 4Q22 (compared to only VND6.4 billion in 3Q22). Among ETFs, Fubon ETF experienced the highest inflow in 4Q22 with VND5,252 billion (41% total inflow), followed by VNDiamond ETF with VND2,890 billion (22.6% total inflow), and V.N.M. ETF with VND2,762 billion (21.6% total inflow).

Net ETF inflows were VND20,853 billion (US$880 million) in 2022, up 4.3 times year on year, owing primarily to the large contributions of Fubon ETF (53.2% of total inflow) and ETF VNDiamond (32.8%).ETF inflows accounted for 81% of total net foreign purchases in 2022.

Mr. Phan Nhu Bach, an analyst at VNDirect, expects the fed fund rate to rise to 5% in the first half of 2023F, with a first 25-bps cut implemented in the first quarter.The USD is expected to maintain its strength throughout 2023. But a combination of improving FX reserves and the FED’s less hawkish stance sometime in mid-2023 would mark an end to the sharp VND drop and provide a potential reversal of about 1-2% appreciation against the US dollar at the end of 2023. This will make the Vietnam market more attractive and continue to attract capital flows from ETFs.

The strong capital inflow into ETFs invested in Vietnam, especially foreign ETFs, also shows that the Vietnam market's recent strong correction has triggered foreign investors to seek growth with a risk appetite. Moreover, the recent downgrade of tech stocks has resulted in a shift into traditional businesses, which is the catalyst for ETFs invested in Vietnam, where banks, property, power, and consumers dominate market capitalization.

VN30 Index 1H23 review

HOSE will announce the VN30 index result on January 16, 2023, with effect on February 6, 2023.Mr. Phan Nhu Bach expects BCM to be included in the VN30 basket while KDH is removed from the VN30 index.

>> Vietnam’s path to emerging market status

Based on VNDirect’s estimate, BCM has a freefloat of above 3% to make its average freefloat adjusted market cap in 2022 above VND2,500bn, which will meet the requirements of the VN30 index in this review period. Once BCM is included in the VN30 basket, KDH, the smallest company in terms of the 2022 average freefloat adjusted market cap (VND24,468bn), will be excluded from this review.

ETFs tracking the VN30 Index, with a current total net asset value of VND8,605 billion (including ETF DCVFM VN30, ETF SSIAM VN30, ETF FUEMAV30, and ETF KIM Growth VN30), will rebalance their portfolios on February 3, 2023. Mr. Phan Nhu Bach estimates that during this review, 294,420 shares of BCM might be bought and 3.8 million shares of KDH will be offloaded.

"Top-bought stocks in terms of value include FPT, VPB, and BCM, with values of VND30.4 billion, VND24.6 billion, and VND23.4 billion, respectively. "KDH and GAS are the top selling stocks in terms of value, with values of VND102.4 billion and VND14.5 billion, respectively," said Mr. Phan Nhu Bach.

PDR might be replaced by SSB.

With the impact of the bond market recently, NVL and PDR stocks' prices corrected sharply, down 81% ytd. and 80% ytd., respectively. This caused the market cap of these stocks to plummet to only VND35,491bn and VND9,738bn, ranking 29th and 61st in the market on December 19, 2022.

Mr. Phan Nhu Bach estimates that the average capitalization of PDR in the 2H23 review will not be enough to stay in the top-40 and will be excluded from the VN30 index. With PDR removed from the VN30, SSB- the largest market cap stock among eligible stocks but not a member of the VN30 Index, will be the VN30's constituent in the 2H23 review.

In addition, if the market capitalization of NVL continuously declines and falls out of the top-40, NVL will also face the risk of being excluded from the VN30 in the subsequent review periods.