Will stocks face volatility pressure during earnings season?

Vietnam’s stock market continued to set new historical milestones in the first days of January, with the VN-Index reaching a newly established peak of 1,877.33 points, surpassing the 2025 price range.

The stock market entered January on a favorable footing, supported by strong momentum and expectations of an official upgrade in September 2025.

However, this January, the release of fourth-quarter 2025 and full-year 2025 financial statements may lead to deeper capital rotation and greater market differentiation.

The Launchpad and Headroom of 2025

Vietnam’s stock market closed 2025 amid many favorable factors and record-breaking figures. The VN-Index reached an all-time high, ending 2025 at 1,784.49 points, up 41% from the beginning of the year. The year also recorded the largest absolute point gain in history, with an increase of more than 517 points. Real estate was the only sector to significantly outperform the broader market, surging 213.8% over the year. Notably, VIC rose 736.5% and VHM climbed 210%, together contributing 342 points to the VN-Index, highlighting the highly concentrated nature of market momentum. This concentration was also reflected in the fact that only 220 stocks on the HoSE gained during the year, while 180 declined.

Vietnam remains on the watch list for consideration of an upgrade to Secondary Emerging Market status in the September 2024 country classification review, with expectations of an official upgrade in September 2025.

Alongside this concentration, after a strong rally, many stocks still trade at relatively low price levels with attractive valuations that have yet to draw commensurate capital inflows, opening up further headroom and prospects for 2026.

Mr. Phạm Lưu Hưng, Director of the Investment Analysis and Advisory Center, noted that Vietnam’s market has also benefited from favorable external conditions and supportive domestic macroeconomic factors. Globally, 2025 marked the third consecutive year of double-digit growth in global equity markets, driven by sustained corporate earnings and the U.S. Federal Reserve’s initiation of a rate-cutting cycle. The U.S. dollar weakened sharply, with the DXY index falling more than 9%, its steepest decline since 2017. The MSCI Emerging Markets Index rose 30.6%, while the MSCI Asia Pacific Index gained 25.3%. U.S. equities continued to reach new highs, with the S&P 500 up 16.4%, led by technology and artificial intelligence stocks.

Domestically, macroeconomic conditions remained positive, with strong GDP growth, well-controlled inflation, and proactive, flexible coordination between monetary and fiscal policies to support high growth while maintaining macroeconomic stability.

In particular, legal reforms and market upgrading represented a pivotal breakthrough. Resolution No. 68-NQ/TW issued in May 2025 and Decree No. 245/2025/NĐ-CP provided a strong boost to the market by promoting the private sector, attracting foreign capital, and triggering a new wave of IPOs by large enterprises. The stable official operation of the KRX system has been a key prerequisite for the introduction of new financial products. In October 2025, FTSE Russell officially announced the upgrade of Vietnam’s stock market to Secondary Emerging Market status, marking an important step in the country’s financial integration.

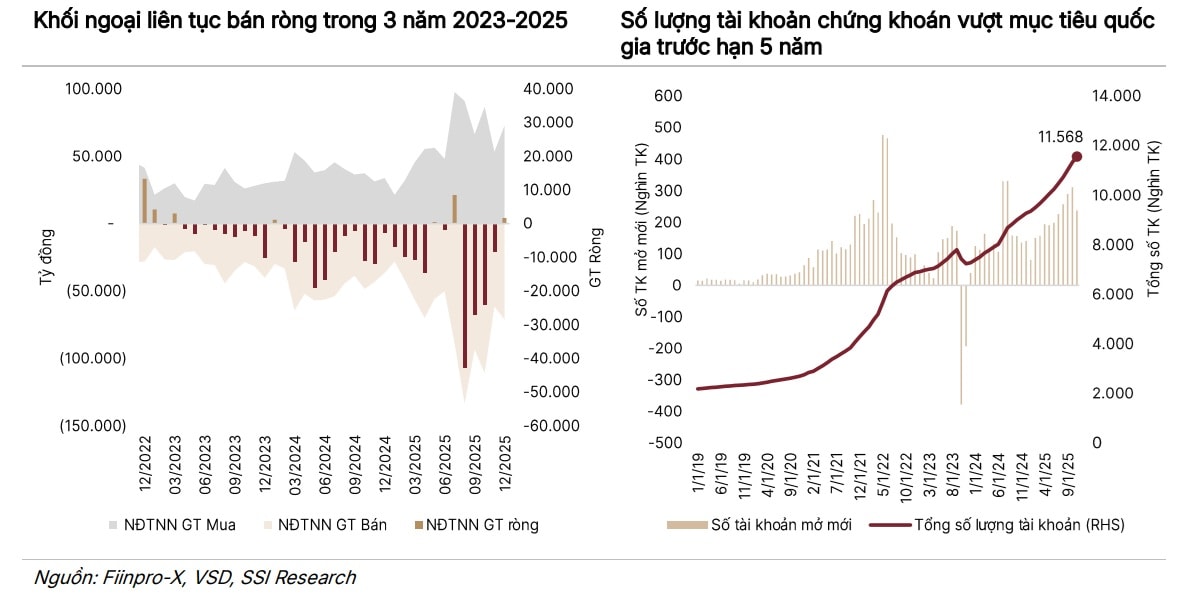

Domestic investor capital flows played a decisive role. Despite foreign investors recording a net sell-off of a record VND 135 trillion in 2025—following heavy net selling in 2024—the market maintained strong upward momentum thanks to domestic capital. The number of securities accounts reached 11.5 million by the end of November 2025, equivalent to around 11.3% of the population, achieving ahead of schedule the national target set for 2030, according to SSI analysts.

Domestic buying demand helped absorb selling pressure from foreign investors

Promising Sectors

Over the past 16 years, January has been the most profitable month of the year, with an average return of around 3.7% and a probability of gains close to 70%. The market also shows a relatively high likelihood of rising during the period between the New Year holiday and the Lunar New Year, according to SSI’s January market report.

Experts from the Investment Analysis and Advisory Center believe that in the short term, positive fourth-quarter earnings growth prospects, improving market liquidity as interest rate pressures ease compared with the end of 2025, and the recent return of foreign investors to net buying in several weeks are key supportive factors.

A notable feature of this month—when companies begin releasing their financial statements—is the likelihood of short-term volatility during the earnings season, according to experts.

Specifically, the market may experience brief corrective phases during earnings season, particularly after the strong rally from mid-November 2025 to early January 2026. However, such corrections are typically short-lived and smaller in magnitude than major corrections seen at other times of the year.

SSI highlights several key investment themes:

First, banking continues to be viewed positively in January, with a high probability of gains and superior average performance. Bank valuations have adjusted to more attractive levels, while profit prospects for Q4/2025 and 2026 remain favorable. Preferred stocks include CTG, MBB, and VPB. VCB is considered a defensive choice due to its superior asset quality and funding advantages.

Second, interest-rate beneficiaries, including insurance companies and firms with large net cash positions—particularly in oil and gas, fertilizers, and consumer goods—stand to gain. Conversely, capital-intensive sectors such as real estate and construction may face rising financial cost pressures.

Third, public investment and construction materials remain key growth drivers. Demand for construction materials is supported by public investment disbursement, social housing projects, and a new legal framework for mining licenses. Companies in steel, cement, plastics, and basic materials are expected to post positive profit growth.

Fourth, State-owned enterprise (SOE) stocks: The Politburo recently issued Resolution No. 79/NQ-TW on the development of the State economy, reaffirming the State sector as an important component of the Vietnamese economy. In addition, under a draft decision to replace Decision No. 22/2021 on criteria for classifying SOEs and state-invested enterprises for the 2026–2030 period—serving the restructuring of state capital—the Government plans to continue ownership restructuring and divestment. State ownership would remain above 65% in seven market sectors (similar to the previous decision), and between over 50% and under 65% in certain sectors such as air transportation, fuel import hubs with a market share of 30% or more, cigarette manufacturing, and providers of telecommunications services with critical network infrastructure (two fewer industry groups than under the previous decision).

Although this draft decision does not introduce many major changes compared with the 2021 decision, the continued implementation of divestment plans, together with the government’s reaffirmation of the role of SOEs, could have a positive impact on market sentiment toward related stocks.

Securities firms may also benefit from the recovery in market liquidity in the early months of the year, alongside prospects for strong earnings growth in the fourth quarter.