Lending rates must be cut further

According to financial analysts, deposit rates have hit their lowest level in years and would be tough to cut further, while lending rates continue to fall.

Transactions at ABBank

>> Lending rate forecast to be cut by 1-1.5pp in 2024

A narrow door to policy rate cut

The Federal Reserve (FED) was anticipated to lower interest rates three times this year at its last meeting in 2023. This raised the prospect of more policy rate reductions in Vietnam. Because the Fed's rate reduction will relieve pressure on exchange rates, allowing the State Bank of Vietnam (SBV) to drop its policy rates.

"In the underlying context, we suggest that the SBV can continue to lower its policy rates by 50 basis points," KB Securities said. Similarly, VNDirect anticipated that the SBV would consider decreasing policy rates by 0.5% in 2Q24, lowering the refinancing rate to 4% and the discount rate to 2%.

However, the projections were made in the end of 2023 and early 2024, and the present situation is different. With unusually high inflation in the United States and a robust employment market, the Fed is unlikely to decrease interest rates soon.

Furthermore, the Vietnamese financial and monetary markets are poorly connected to the rest of the globe, despite the fact that the SBV has slashed interest rates faster than the Fed. So, even if the Fed cuts rates, the SBV has little motivation to do so, especially because inflation in Vietnam is rising and the economy is improving favorably.

>> Lending rates may drop even lower

"As the Vietnam economy recovers, the probability of more rate cuts has lessened. As a result, the SBV would maintain the current refinancing rate of 4.50%, according to a report provided a few days ago by UOB.

More loan rate cuts needed

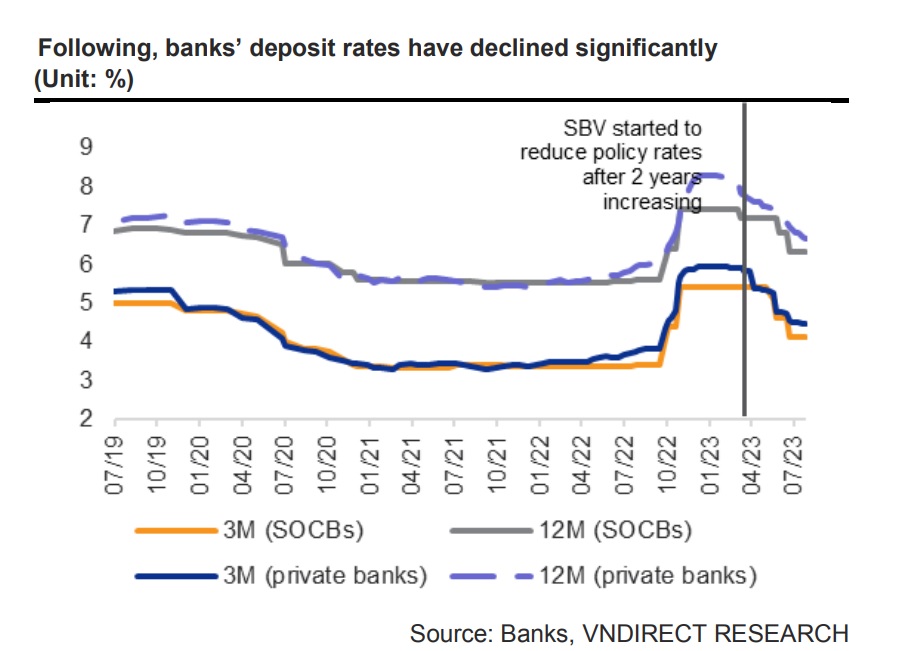

The analysts from KBSV and VNDirect said that deposit rates have reached a historic low and will remain horizontal for most of 2024.

Not only did the bank's deposit rates struggle to fall further, but Dr. Nguyen Tri Hieu, a banking specialist, anticipated that they would climb beginning in 2Q2024, owing to the economic recovery, which will increase loan demand and drive banks to raise their deposit rates in order to attract capital.

That being said, experts believe that lending rates may continue to decline, owing to the fact that lending rate drops are far slower than deposit rate reductions.

Recognizing this, one of the leaders of the SBV's Monetary Policy Department stated that interest rates had fallen fast in recent years. However, up to 80% of banks' deposits are short-term, while more than half of their outstanding loans are medium- to long-term. As a result, the fall in medium- and long-term lending rates is coming later than the decrease in deposit rates.

That is why, according to Dr. Nguyen Tri Hieu, loan rates may be further reduced. Dr. Dinh Trong Thinh, a financial analyst, also advised that lending rates be decreased further to reflect the existing very low deposit rates. More precisely, KB Securities anticipated that the average loan rate would be reduced by 0.75–1.0%, while VNDirect estimated that lending rates would be reduced by 0.5–1% on average.