SBV expected to hold policy rates steady in 2026

The State Bank of Vietnam (SBV) is likely to keep its policy rates unchanged throughout 2026 as long as inflation remains under control and authorities continue to prioritize stronger GDP growth, according to Maybank economists Brian Lee Shun Rong and Chua Hak Bin.

Maybank expects headline inflation to edge higher to 3.7% in 2026 as domestic demand strengthens.

Q4 GDP Growth: Slight Softening Due to Storm Disruptions

Severe storms have disrupted domestic activities, exerting a modest drag on fourth-quarter growth. Maybank reiterates its full-year GDP growth forecast of 7.8% for 2025, with Q4 GDP expected to ease to around 7.7% (down from 8.2% in Q3). Export also cooled in November due to bad weather, though overall orders remain robust. Exports rose 15.1% year-on-year—slower than October’s 17.5%—while imports increased 16%. The trade surplus narrowed to a six-month low of USD 1.1 billion.

Exports to both the US and China decelerated but still outperformed most other markets. Total export turnover fell 7.1% month-on-month, the sharpest drop since September 2024, with textiles, seafood and phones hit hardest. While US tariff risks may be weighing on non-electronics demand, Maybank argues the November contraction was likely driven more by extreme weather than weakening global appetite.

S&P’s PMI survey also reflects supply-chain disruptions from storms, with supplier delivery times stretched to their longest since May 2022. Even so, new export orders saw the strongest rise in 15 months. Factory activity remains solid both annually and sequentially, signaling strong business confidence. Manufacturing output grew 11.8% year-on-year, while employment in the sector rose 3.9% by early November.

Retail sales growth softened only slightly, and international tourist arrivals grew 15.6%, though storms and landslides weighed on services in the Central region.

Inflation Dynamics and Interest Rates

Food prices climbed following flooding in the Central provinces, pushing headline inflation to a five-month high of 3.6% in November. Month-on-month inflation rose 0.45%. Average inflation in the first 11 months reached 3.3%, close to Maybank’s full-year forecast of 3.2%.

Maybank expects headline inflation to edge higher to 3.7% in 2026 as domestic demand strengthens.

Despite SBV’s liquidity injections, interbank rates remain elevated. The central bank recently raised the OMO lending rate by 50 basis points to 4.5%—a tool mainly used for liquidity management rather than signaling a policy-rate shift. Liquidity has tightened due to year-end credit demand, prompting banks to raise deposit rates.

Importantly, the last time SBV raised the OMO rate (May 2024), it did not lead to any subsequent policy-rate hikes. SBV later cut the OMO rate back to 4% in August–September 2024 when liquidity pressures eased.

On the external front, public-sector investment disbursement has slowed due to storm impacts, while new FDI pledges weakened amid high-tech incentive concerns from Korea. Although FDI disbursements rose 8.9% to USD 23.6 billion in the first 11 months, newly registered capital fell 8.2%.

Maybank now forecasts 7.6% GDP growth for 2026, up from its previous 7.2%. They expect exports to remain resilient despite tariff headwinds, supported by the global AI-capex boom and continued FDI inflows into electronics. Domestically, infrastructure investment, supply-chain restructuring, digitization, AI adoption and new international financial centers will strengthen fixed-asset formation. Consumption should recover as the labor market remains strong and tourism continues to improve.

Against that backdrop, their base case is that SBV keeps policy rates unchanged throughout 2026 as long as inflation remains within target and growth objectives take priority.

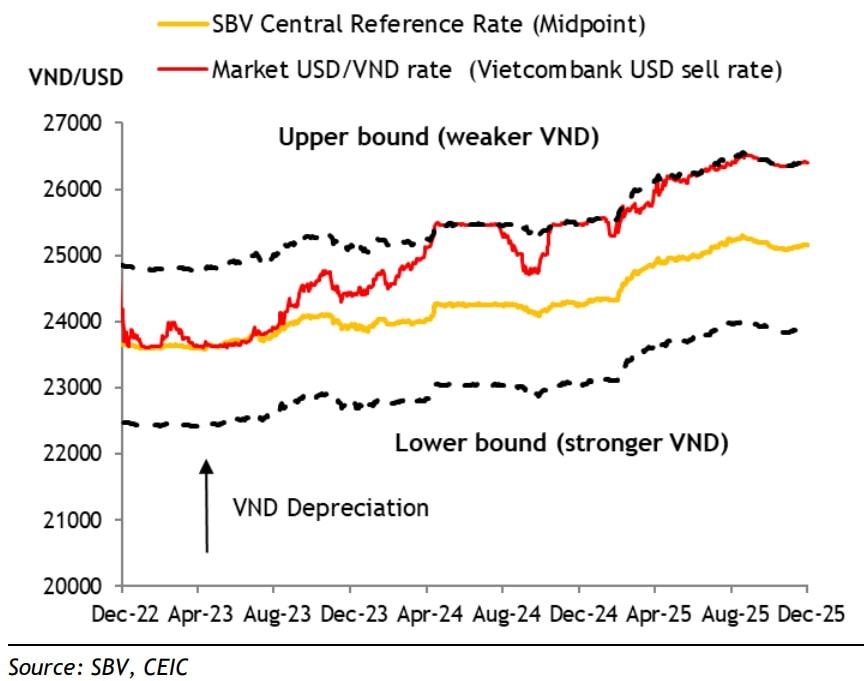

However, risks are tilted toward tighter monetary policy if growth overshoots, inflation broadens, or exchange-rate pressures persist. Maybank’s FX team expects the dong to weaken slightly to 26,650 per dollar in 2026 (−0.4%), after a 3.4% depreciation this year. The VND is likely to stay near the upper end of the SBV’s trading band.